By Berber Kramer and Gabriel Munene Laiboni

Kenya’s agricultural sector is very important to its economy. However, as in other African countries south of the Sahara, it is increasingly vulnerable to vagaries of climate change, with climate-related risks affecting food production, food and income security, and having spillover effects to the wider economy. In the absence of urgent action against climate change, the economic prognosis, and impacts in terms of food security look bleak. Management of agricultural risks requires a holistic approach. To address challenges related to climate change, such as erratic weather patterns, farmers will need to adapt how they grow their crops and manage their livelihoods. This includes adopting seeds of stress tolerant varieties and using crop insurance to reduce the amount of risk that their farming enterprise faces.

Puzzling Seed Adoption Statistics

A recent workshop on innovations in agricultural risk management, which took place on November 18th 2022 at The Social House, Nairobi, confirmed that farmers in Kenya still primarily grow old seed varieties. The workshop shared findings from an agricultural research-for-development program that worked in seven counties spread across Kenya, with the aim of identifying how to increase the adoption of drought-tolerant varieties.

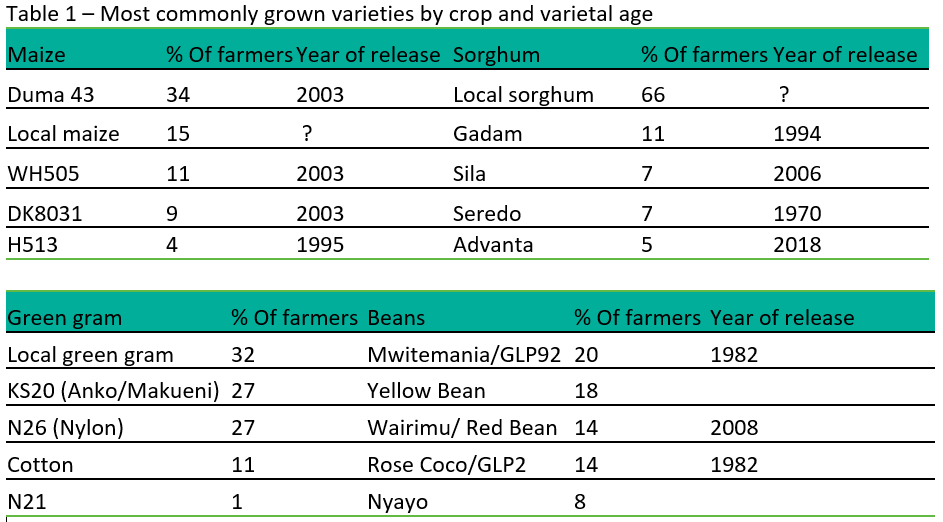

As per the table below, many farmers still grow local non-improved varieties, and the most commonly grown varieties of maize, sorghum, green grams, and beans among farmers surveyed as part of the project were released over 15 years ago. The only exception was a sorghum variety from Advanta Seeds, which had been released in 2018, but had been promoted actively through the project, explaining its higher uptake. This low varietal turnover is notwithstanding large investments in crop improvement in the past decades, and the widespread availability of highly improved, and more drought-tolerant, newer varieties.

Source: Author calculations based on percentage of farmers using a given variety is derived from the midline survey data of the project “Promoting stress-tolerant varieties at scale: Interlinking the seed sector and insurance-advisory services”. The year of release is derived from KEPHIS’ updated 2020 August national variety list.

Ironically, the surveyed farmers cited high yields, drought tolerance, short maturity and overall produce quality as the main reasons for why they stuck with the old varieties; even though newer varieties are supposed to outperform old varieties in all those metrics.

Farmers’ reluctance to adopt newer varieties implies that seed companies need to invest more in customer relations, marketing and product development. The research project showed that providing trial packs increased adoption of varieties promoted through these trial packs, but overall, adoption remained low. This was not because of a lack of access: providing drought-tolerant varieties to farmers’ doorstep did not further increase adoption, showing that more needs to be done to encourage farmers to adopt newer varieties.

Pictured Based Insurance (PBI): A Solution?

One explanation of why the adoption of drought-tolerant varieties remains low, even among farmers who received trial packs of these varieties and observed their performance first-hand, could be that the seeds are more expensive, and that a farmer is, in a way, taking a risk by investing in these seeds. Although the seeds are more tolerant than regular varieties against certain kinds of droughts, severe droughts as well as other perils can still damage a farmer’s crop. Since seeds of newer varieties are more expensive and still carry an intrinsic risk, it is rational for farmers to want to minimize investments in their farms by choosing lower-cost inputs.

These risks could be potentially reduced if farmers have access to better insurance. One challenge, though, is that existing insurance products are often based on weather-based proxies for crop losses, instead of actual crop damage. Verifying actual crop losses through in-person visits of small remote farmers would be too expensive and raise insurance premiums to unaffordable levels. Furthermore, weather index-based insurance solutions (WBI) are often inaccurate, have a reputation of failing to make payouts to farmers with crop losses, and suffer low demand.

The workshop therefore introduced Picture-Based Insurance (PBI), developed first by IFPRI in the context of India and later adopted by ACRE Africa in Kenya, as a potential solution. By making payouts based on whether damage is visible from smartphone pictures of insured crops, insurers can verify whether farmers with claims indeed suffered crop losses at a minimal cost. Research found that relative to WBI, PBI improves perceptions and attitudes towards insurance, increasing demand for insurance products (figure below).

Figure 1 Perceptions of, and demand for insurance, by type of insurance product

Source: Author calculations based on midline survey data of the project “Promoting stress-tolerant varieties at scale: Interlinking the seed sector and insurance-advisory services”.

Challenges

Demand for insurance, however, is only a means to an end. Through a randomized controlled trial implemented around the roll-out of PBI, the research program analyzed to what extent this insurance product increases technology adoption, investments in farms, and, more specifically, the adoption of stress-tolerant varieties. In contrast to what was expected, there was no impact of either WBI or PBI on technology adoption or investments. Having insurance coverage for investments in more expensive seeds also did not lead more farmers to use stress-tolerant varieties or increase their investments in these seeds.

These findings could imply that the investment risk associated with the increased cost of stress-tolerant varieties is not a barrier to adoption. But it could also be that there were other challenges related to implementation, or that farmers face additional barriers to adoption, which need to be addressed for PBI to have an impact on farmers’ livelihoods. Two of these challenges along with their solutions were discussed in the workshop.

First, farmers may lack knowledge on the benefits of the stress-tolerant varieties. Indeed, IFPRI research found that when farmers were growing the varieties promoted through trial packs in their fields, these varieties did not improve observed drought tolerance as clearly as one would expect based on agronomic trials. Perhaps farmers needed access to better extension services on how to maximize their returns on investments in their seeds. Images taken for farmers with PBI coverage are therefore being used to create a brand-new innovation: Picture Based Advisories (PBA). If a farmer is in need of any agronomic advice, they can take pictures of their affected crops and upload them to seek agronomists’ advice on appropriate remedial measures. An impact evaluation of this innovation is currently underway.

Another challenge is more implementation related. Farmers with PBI coverage have not received their payouts as quickly as one would hope, given that processing the images and reviewing them for damage relies on agricultural experts making time in their busy schedules for this activity. The dependency on human expertise has often caused delays in claims settlement, which may in turn limit the impacts of PBI on investments; in fact, at the time of the endline survey used to measure impacts, farmers with visible crop damage had not yet received their PBI payouts from the previous season, and thus, there was limited scope for farmers to use payouts to increase investments in their farm, or have increased investor confidence for the next season, having witnessed how the product works. To address this challenge, data collected thus far can be used to train deep learning algorithms, with the aim of enhancing both accuracy and speed of processing PBI claims.

Way forward

During the workshop, ACRE Africa shared its view on how the picture-based insurance concept can be scaled. One pathway to scaling is to apply it in areas for which parametric insurance is unavailable, for instance insurance coverage for pests and diseases, which can be spotted from pictures of affected crops.

Moreover, although PBI can make commercial sense strictly as an insurance service, there are product development innovations that can make it even more helpful to both underwriters and farmers. For instance, the insurance component can be augmented with a satellite imagery-based soil moisture index to enhance the accuracy of actuarial pricing, monitoring, and claims processing.

Finally, the workshop identified engagement with policy stakeholders to entrench promotion of crop insurance into the existing agricultural insurance and seed regulations as a key step to commercialization, and to protecting smallholder farmers from the adverse impacts that climate change can have on their livelihoods.

Berber Kramer is a Senior Research Fellow in the Markets, Trade, and Institutions Division of the International Food Policy Research Institute (IFPRI), and is based in Nairobi, Kenya.

Gabriel Munene Laiboni is the Director of Research Support and Dissemination at KCA University and is based in Nairobi, Kenya.

This work is part of the CGIAR Research Initiative on Market Intelligence and Product Profiling for Impactful Breeding, and funded by the NL-CGIAR research program on Seed Systems Development, the ISSD Africa program, as well as Phase 2 of the ACIAR-IDRC-supported Cultivate Africa’s Future program. We would like to thank all funders, including those who support our research through their contributions to the CGIAR Trust Fund: https://www.cgiar.org/funders/