This blog is cross posted from CGSpace.

Since September 2022, the government of Kenya has been implementing policy measures under its “Bottom-Up Transformation Agenda (BETA)”. Alongside measures aimed at promoting economic recovery and improving livelihoods, the government is also redesigning revenue mobilization instruments geared towards fiscal consolidation and supporting economic growth. These interventions have already yielded some progress. For example, the latest GDP report indicates that Kenya’s economy grew by 5.9 percent in the third quarter of 2023 – up from 4.3 percent in the same quarter in 2022.

To enhance revenue mobilization and raise taxes, the government has started to implement the National Tax policy and the Medium-Term Revenue Strategy (MTRS) for fiscal years 2024/25 to 2026/27. This is expected to raise tax collections from its current 16.0 percent of GDP in 2023/24 to above 20 percent over the medium term.

The MTRS outlines broad interventions affecting income taxes, VAT, excise duties, miscellaneous fees and levies, custom duties, and non-tax sources of revenue. In addition, the MTRS highlights sectors where the government is exploring new tax measures, among them, the agricultural sector. Even though the economy is dependent on agriculture, the sector contributes only 3 percent to tax revenues, which, according to the MTRS report, implies an under-taxation of the sector. The government has therefore proposed introducing a withholding tax, under which agricultural produce delivered to cooperatives or other organized groups would be taxed at 5 percent or less of its value.

If this agriculture withholding tax proposal highlighted in the MTRS was to be implemented, assessing the economy wide impacts is paramount, not only as a contribution to evidence decision making process, but also as a way of engaging with stakeholders in the policy space for coherence.

Cooperatives have long been an innovative approach to help farmers overcome market failure and improve their livelihoods. The International Labour Organization estimates that 63 percent of Kenyans are part of cooperative enterprises. Farming cooperatives are especially important – about 75 percent of Kenya’s agricultural labor force participates in agricultural activities through cooperatives. Agriculture cooperatives are distributed across many value chains, where coffee and dairy having the highest number of cooperatives in Kenya. Farming cooperatives provide members access to technological innovation and extension services and link farmers to higher value markets (Fischer, 2012).

Given the central role of cooperatives and organized farmers in agricultural value chains, introducing a withholding tax on agricultural produce sold through cooperatives could have large implications for the entire agricultural sector as well as the broader economy. It could have detrimental impacts on household livelihoods, especially for smallholder farmers.

Using IFPRI’s RIAPA model, Kenya Institute for Public Policy and Research Institute (KIPPRA) in collaboration with International Food Policy Research Institute (IFPRI) undertook an assessment of the potential economywide impacts of introducing the proposed 5 percent withholding tax on the economy, agrifood system, rural livelihoods, and poverty. The results of this assessment were shared with both government and private sector representatives through a workshop event that took place on April 5. The workshop event attracted diverse representation from the cooperatives, farmers association, county government, private sector, National Cereals and Produce Board, national government, among others. The Executive Director, KIPPRA rose Ngugi welcomed the stakeholder and said, “I congratulate the team and happy to have convened such a timely event based on rigorous evidence on an important policy topic”. There were reactions from the stakeholders for example from Kenya Revenue Authority “this was a useful exercise to inform policy and that we are keen for further collaboration”

The 5% tax is applied to all agricultural output regardless of whether it sold via cooperatives. Since it is difficult to predict how farmers will react to the new tax, this scenario provides an upper bound estimate of potential impacts of the withholding tax. The revenues from the withholding tax are assumed to reduce the government’s recurrent fiscal deficit.

- Cooperative Tax Incidence scenario.

The 5% tax is only applied to agricultural output sold through cooperatives. This scenario provides a “best guess” at the tax’s impact based on current cooperative sales data. Unfortunately, data on how much output is sold through cooperatives is unavailable for many agricultural products. In these cases, the share of sales via cooperative is initially set at the average of products with data, and then scaled downwards based on the government’s projected revenues from the withholding tax. Tax revenues are again assumed to reduce the government’s deficit.

- Cash Transfer scenario.

The 5% tax is applied in the same way as in the “cooperative tax incidence” scenario above. In this is scenario, however, we assume that the revenues from the withholding tax are used to provide (additional) cash transfers to households in the bottom three income quintiles (i.e., poorest 60% of Kenyans). We assume a 15% administrative cost to implementing the program. Overall, the cash transfers are equivalent to providing $1.6 to each Kenyan in the bottom three quintiles.

- Agricultural Investment scenario.

The final scenario again imposes the 5% tax on sales via cooperatives (as per the above two scenarios), but the tax revenues are now used to invest in raising agricultural productivity, as opposed to providing cash transfers. We assume a productivity growth to spending elasticity of 0.18, implying that a 100% increase in public spending on agriculture leads to a 18% increase in agricultural productivity.

Model results are summary:

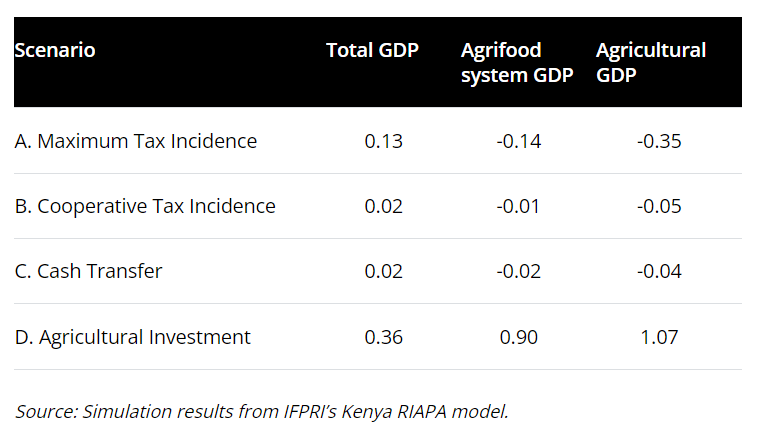

Table 1 shows changes in gross domestic product (GDP), which is a measure of the incomes generated in different parts of the economy (i.e., across the whole economy, within the agrifood system, and within just primary agriculture). The tables shows that the impact of the agricultural withholding tax on GDP is expected to be small, mainly because the tax does not directly affect the productive capacity of the agricultural sector. Agricultural GDP falls because consumers reduce purchases and consumption when prices tax rise after the tax is introduced. The impact on primary agriculture GDP is notably much higher than that of Agri-food system GDP because of its narrow scope than the latter. The Agri-food system has a broader scope as it encompasses an entire range of actors interlinked with primary agriculture production. This impact on both the Agriculture GDP and Agri-food system points to the negative impacts on food security and poverty levels in Kenya. Farmers’ agricultural incomes are indirectly affected by falling demand, which prevents them from passing the full cost of the tax onto consumers.

Using the tax revenues collected by transferring cash to poor households does not do much to reduce the negative GDP impact, because the country’s underlying productive capacity remains unchanged. However, reinvesting tax revenues into raising agricultural productivity does enhance production capabilities, leading to higher agricultural GDP. The decision about whether and how to use the withholding tax revenues matters for the Kenyan economy.

Table 1: Change in GDP caused by withholding tax (%)

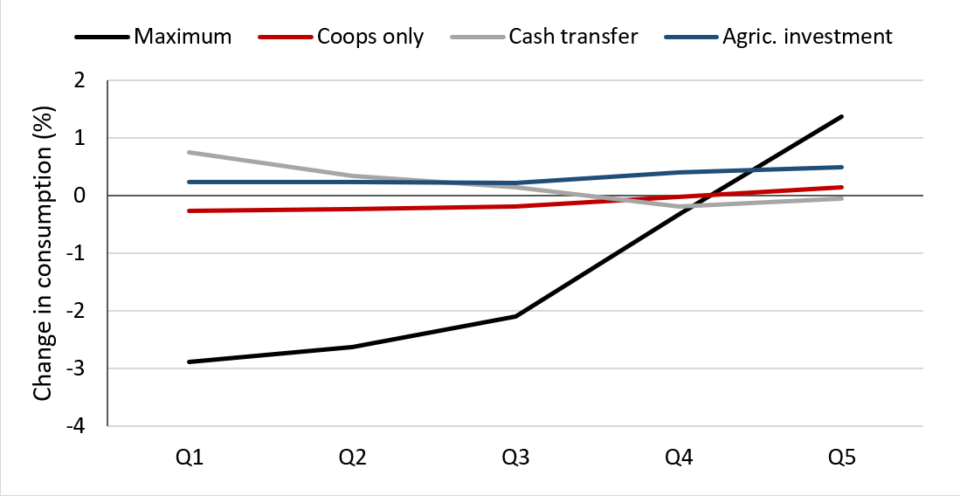

Figure 2 shows changes in consumption levels for households in different quintiles (i.e., Q1 are the poorest households and Q5 are the least poor). Results indicate that low-income households would be most adversely affected by a 5% withholding tax, because food consumption is a much larger part of their consumption basket and because farming is a more important source of their incomes. Without reinvesting in the sector, the agricultural withholding tax is potentially regressive, with higher income households benefitting from the macroeconomic effects of smaller government deficits. When the tax is only imposed on products sold through cooperatives, then the negative impact on the low-income household consumption is smaller but remains slightly regressive. Cash transfers are effective at mitigating negative impacts on poor households, whereas reinvesting in agricultural productivity has a neutral, but positive, impact on the distribution of incomes. Again, the choice over how to use the revenues collected will determine who are the winners and losers from the withholding tax.

Figure 2: Change in per capita consumption by quintile (%)

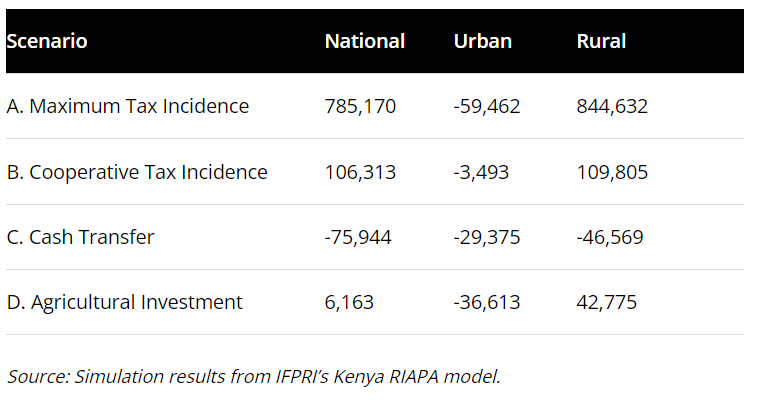

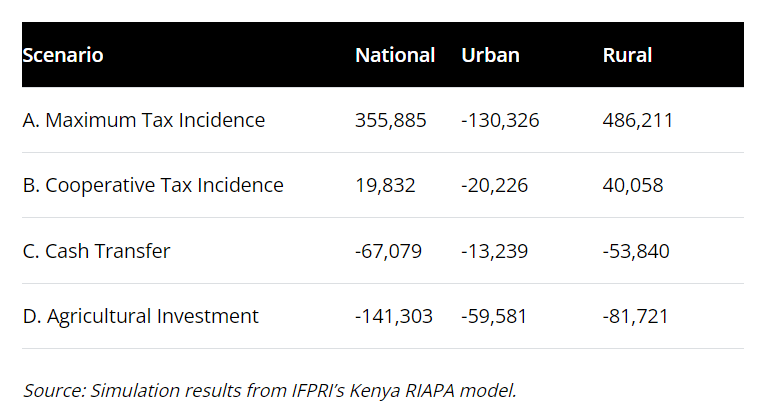

Tables 2 and 3 show that, without the use of revenue collected, the agricultural withholding tax would increase the number of poor and undernourished people in Kenya (i.e., people whose consumption of own produced and purchased products sums to less than $2.15 per day or whose food consumption amounts to less the minimum required number of calories per day). Rural households are the worst affected as more are falling into poverty (7.9 percent increase) -from the base-under maximum tax incidence, and under cooperative tax incidence 1 percent increase (see table 2). This is because they not only face higher food prices, but also experience a decline in farm incomes caused by lower farm-gate prices. This increases the likely of households falling into income poverty or not consuming a minimum number of calories per day to avoid hunger. The numbers of undernourished increases by 3.2 percent and 0.2 percent from the base under maximum tax incidence and cooperative tax incidence, respectively (see table 3). Impacts are much smaller, or even beneficial, when revenues are used to finance cash transfers or reinvest in agriculture. The impact of the withholding tax on urban households is much less as they face only higher food prices while incomes largely not impacted.

Table 2: Change in poor population due to tax (people)

Table 3: Change in undernourished population due to tax (people)

In summary, the modelling reveals important trade-offs from taxing agriculture that will need to be managed to avoid jeopardizing national and household incomes and well-being. Given the importance of food and agriculture for low-income households, it is not surprising that taxing agriculture could result in lower GDP and higher poverty and undernourishment in the country. However, the modelling also shows how the recycling of revenues is at least as important as the targeting the withholding tax towards cooperatives. Using tax revenues to finance well-targeted cash transfers could reduce poverty, and reinvesting in agricultural growth could benefit all households in Kenya. Agriculture remains an important engine of economic development and a well-designed tax program with progressive recycling could make the sector even more effective at reducing poverty and hunger in Kenya.

Links

Medium-Term-Revenue-Strategy-2023.pdf (treasury.go.ke)

https://www.treasury.go.ke/wp-content/uploads/2024/02/2024-Budget-Policy-Statement.pdf

Q3-2023-GDP-Report.pdf (knbs.or.ke)

Author:

Lensa Omune, Research Officer, IFPRI

Juneweenex Mbuthia, Research Officer, IFPRI

James Thurlow, Unit Director, Foresight Policy and Modeling, IFPRI

Xinshen Diao, Senior Research Fellow, IFPRI

Clemens Breisinger, Lead, CGIAR Initiative on National Policies and Strategies (NPS) and Country Program Leader, Kenya, IFPRI

Rose Ngugi, Executive Director/Board Secretary, Kenya Institute for Public Policy Research and Analysis (KIPPRA)

Joshua Laichena, Principal Policy Analyst, KIPPRA

Kenneth Malot, Senior Policy Analyst, KIPPRA

Adan Shibia, Senior Policy Analyst, KIPPRA

This blog is part of a broader collaboration between the Kenya Institute for Public Policy Research Analysis (KIPPRA), the International Food Policy Research Institute (IFPRI) and the CGIAR Initiatives on National Polices and Strategies (NPS) and Foresight. We would like to thank all funders who supported this research through their contributions to the CGIAR Trust Fund.

Photo Credit: IFPRI Kenya